How to deduct medical expenses in your German income tax return!

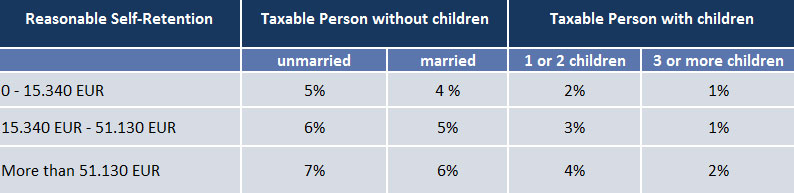

Medical expenses can be deducted as extraordinary expenses. However, the so called reasonable self-retention has to be considered i.e. medical expenses only can be deducted when exceeding a certain amount. This amount depends on your total income, number of children and family status. The following chart shows when you can deduct medical expenses.

Example 1

A married couple, no children, total income of 60.000 € and medical expenses with the amount of 3.000 €.

Reasonable self-retention:

6 % x 60.000 € = 3.600 €

In that case the medical expenses do not have a positive influence as the reasonable self-retention is higher than the medical expenses.

Example 2

A married couple, no children, total income of 50.000 € and medical expenses with the amount of 4.000 €.

Reasonable self-retention:

6 % x 50.000 € = 3.000 €

In that case the medical expenses with the amount of 1.000 €can be deducted as extraordinary expenses.